Pool Clearing

A free trade solution based on EF Schumacher's Proposal in 1943

(Press spacebar or click on the arrow on the lower right to continue. Press Esc to browse the slides)

What are the Problems with the USD as International Currency?

US Policy arbitrarily affects national economies that transact using the US Dollar.

National currencies are subject to attack by speculators who use the US Dollar.

External debt becomes attractive initially, and then becomes dangerous as the currency depreciates.

Exporters and importers are immediately affected by fluctuations

Solution: Pool Clearing

Banks form a pool that acts as one entity, using a common ledger to clear cross-border local currency transactions for remittances and import/export.

Clearing Funds

Each bank sets up a clearing fund in local currency which provides liquidity for the pool.

The fund is used to pay cash directly for remittances and exporters. The fund is filled by cash from micro, small, medium, and large investors who have saved money by using the Pantrypoints system of delayed-barter. This is why Pantrypoints comes before Pool Clearing.

The Old Way of Remittance Using the USD

The old way requires 3 steps, with many intermediary banks which add to the cost.

Click on the maximize button below to view the video

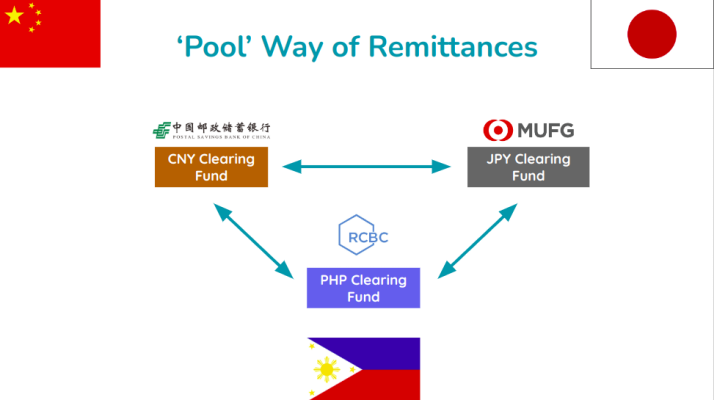

The Pool Way of Remittances without the USD

Member banks adjust their funds to clear cross-border transactions. Transactions only need 2 large steps and 2 banks.

Click on the maximize button below to view the video

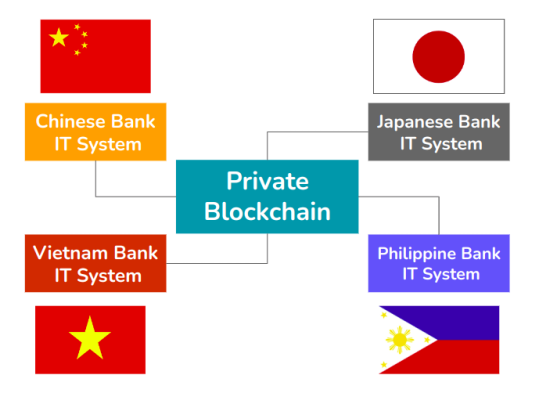

Private Blockchain as the 'Clearing Ledger'

The Pool will use a private blockchain to act as a reference for the interbank transactions.

The Old Way of Foreign Trade Using the USD

The old way denotes prices in USD and requires letters of credit.

Click on the maximize button below to view the video

The 'Pool' Way of Foreign Trade

The pool way uses clearing funds instead of the USD. All prices will be in local currency. Credit-worthiness will be verified by the Pantrypoints system.

Click on the maximize button below to view the video

Points Mechanism

1 Point = Price of 1 kg rice

Pool Clearing replaces the USD with the local price of basic rice as the basis of value.

| Year | Rice per kilo | Peso per USD | Difference |

|---|---|---|---|

| 2003 | 21 pesos | 54 pesos | 33 |

| 2010 | 27 pesos | 47 pesos | 20 |

| 2018 | 32 pesos | 50 pesos | 18 |

| 2020 | 35 pesos | 51 pesos | 16 |

| 2022 | 38 pesos | 58 pesos | 20 |

This will create stability in the pool economies, different from the current volatile pricing of stocks and oil.

The Banks Earn from the Spread of the Clearing Funds

Assuming:- RCBC sets up a coconut fund that will earn 5% annually

- A coconut exporter needs 100k pesos to export to Japan DDP

- It gets 100k pesos from the fund, while its Japanese buyer pays 107k pesos equivalent value in yen

- Bank of Mitsubishi gets the yen payment and earns 2% spread which includes insurance risk

- RCBC earns when the Philippines imports from overseas

Trade is sped up at minimal cost.

Pool Clearing is an Expansion of the Pantrypoints system

The Pantrypoints system is designed to save cash which can then be used to spur world trade, via Pool Clearing, in order to get rid of stagflation.For more information

| Founder | Juan Dalisay Jr. |

|---|---|

| Website | pantrypoints.com/pool |

| Mobile | 09605 424 101 |

| [email protected] |